POR QUE DAR

Misión

Nuestra misión en YouthPower365 es inspirar, educar y capacitar a los jóvenes y las familias desde la primera infancia hasta la preparación universitaria y profesional.

Impacto

Al apoyar a YouthPower365, nos ayuda a brindar oportunidades de aprendizaje extendido de alta calidad a más de 4,000 jóvenes en el condado de Eagle. Para mantener nuestros programas asequibles y accesibles, menos del 2 % de nuestros ingresos proviene de las tarifas. ¡Esto significa que el 98% de nuestros ingresos para servir a la juventud proviene de donantes generosos como usted!

INCENTIVOS PARA DAR

Crédito Tributario por Contribución al Cuidado Infantil de Colorado (CCTC)

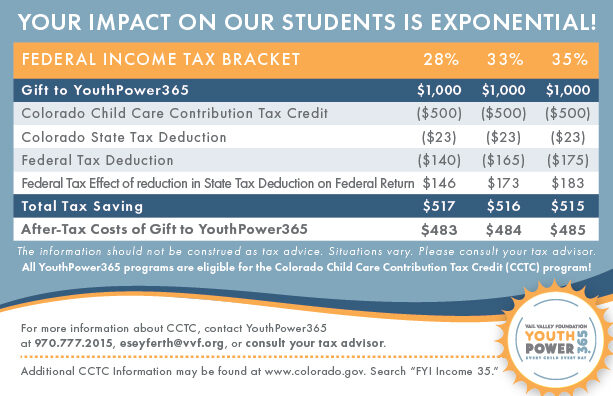

Los partidarios de YouthPower365 de la Fundación Vail Valley que pagan impuestos sobre la renta del estado de Colorado pueden calificar para un crédito tributario sobre la renta de hasta el 50% de una contribución mediante el uso del Crédito tributario sobre la contribución al cuidado infantil de Colorado (CCTC), además de las deducciones fiscales estatales y federales regulares .

Pautas del programa CCTC

-

- El 50% del monto de su donación se aplicará a su crédito fiscal

- El crédito permitido no puede exceder los $ 100,000 o su obligación tributaria por el año

- Los créditos se pueden transferir hasta por cinco años.

- El crédito no es válido para transferencias de acciones o donaciones en especie, o cuando se reciben beneficios

- Puede reclamar el 100% del total de los créditos fiscales obtenidos a través de las contribuciones realizadas, más los créditos restantes de años anteriores.

- El crédito se aplica a las donaciones realizadas a todos los programas de YouthPower365 que apoyan a los jóvenes del condado de Eagle desde la primera infancia hasta los 18 años.

- ¡Todos los programas de YouthPower365 desde la primera infancia hasta los 18 años son elegibles para el programa de Crédito Tributario de Contribución para Cuidado Infantil de Colorado (CCTC)!

Si desea recibir un Crédito Fiscal de Contribución para el Cuidado de Niños de Colorado (CCTC) por este regalo, indique su preferencia en el campo correspondiente al completar su donación.

Contacto Euginnia Seyferth al 970.777.2015 o eseyferth@vvf.org para obtener más información acerca de las formas de apoyar a YouthPower365.